Redwood City Property Tax Bill . Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. if you did not receive a bill, or if you recently purchased a property, you may obtain a duplicate tax bill by calling (866) 220. redwood city, ca 94063. What should i do if i do not have a secured property tax bill? the city of redwood city imposes taxes, assessments and fees, including a business license tax, transient occupancy tax,. The treasurer/tax collector prepares and. Handles records of property descriptions,.

from www.hauseit.com

Handles records of property descriptions,. the city of redwood city imposes taxes, assessments and fees, including a business license tax, transient occupancy tax,. What should i do if i do not have a secured property tax bill? The treasurer/tax collector prepares and. Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. if you did not receive a bill, or if you recently purchased a property, you may obtain a duplicate tax bill by calling (866) 220. redwood city, ca 94063.

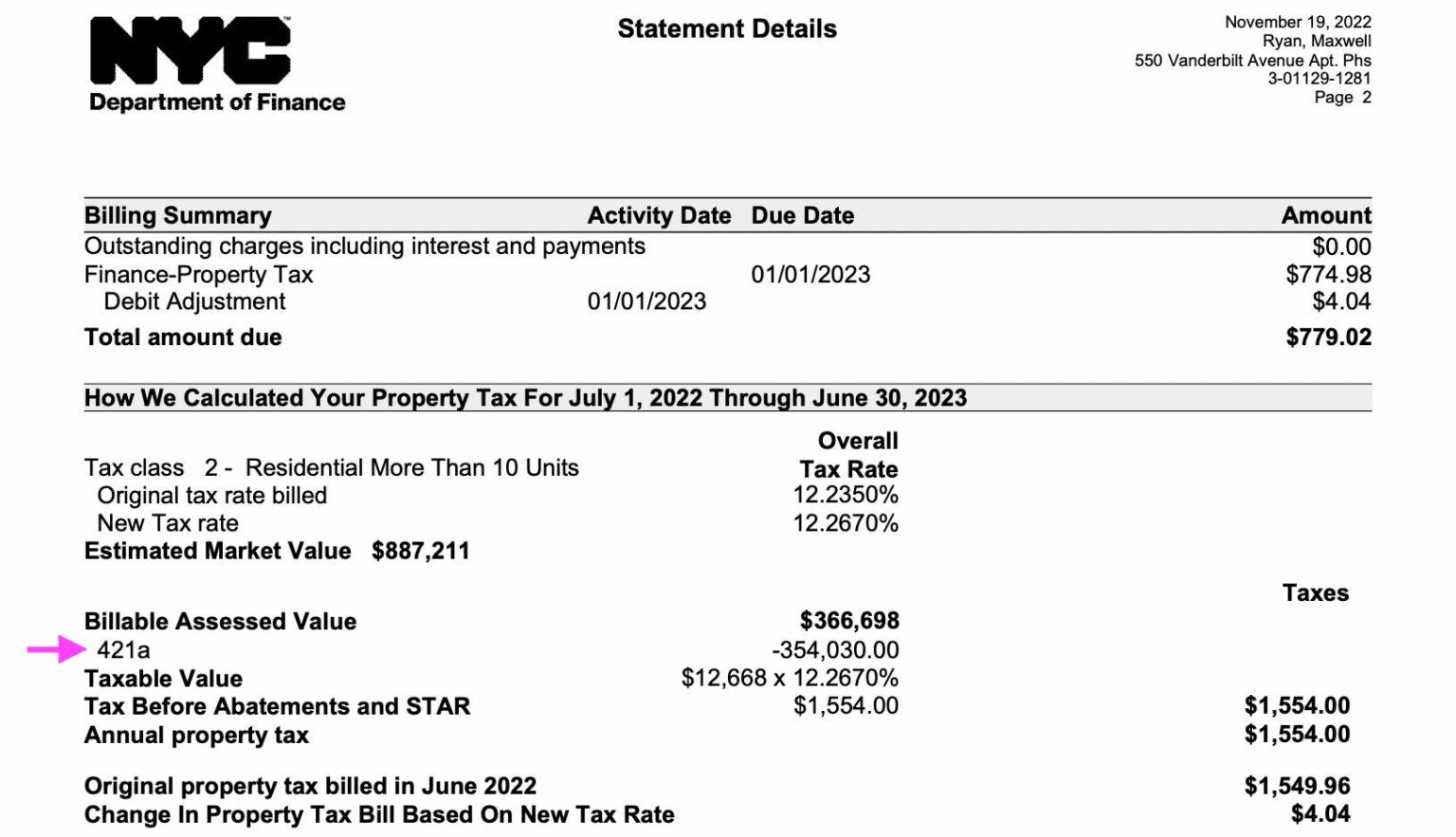

NYC Property Tax Bills How to Download and Read Your Bill

Redwood City Property Tax Bill redwood city, ca 94063. Handles records of property descriptions,. if you did not receive a bill, or if you recently purchased a property, you may obtain a duplicate tax bill by calling (866) 220. the city of redwood city imposes taxes, assessments and fees, including a business license tax, transient occupancy tax,. Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. What should i do if i do not have a secured property tax bill? The treasurer/tax collector prepares and. redwood city, ca 94063.

From www.onfocus.news

Your Guide to City of Marshfield Property Tax Bills OnFocus Redwood City Property Tax Bill What should i do if i do not have a secured property tax bill? Handles records of property descriptions,. The treasurer/tax collector prepares and. if you did not receive a bill, or if you recently purchased a property, you may obtain a duplicate tax bill by calling (866) 220. redwood city, ca 94063. Property taxes in redwood city. Redwood City Property Tax Bill.

From www.hauseit.com

NYC Property Tax Bills How to Download and Read Your Bill Redwood City Property Tax Bill Handles records of property descriptions,. What should i do if i do not have a secured property tax bill? redwood city, ca 94063. the city of redwood city imposes taxes, assessments and fees, including a business license tax, transient occupancy tax,. Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting. Redwood City Property Tax Bill.

From www.tax.ny.gov

Property tax bill examples Redwood City Property Tax Bill redwood city, ca 94063. The treasurer/tax collector prepares and. if you did not receive a bill, or if you recently purchased a property, you may obtain a duplicate tax bill by calling (866) 220. Handles records of property descriptions,. the city of redwood city imposes taxes, assessments and fees, including a business license tax, transient occupancy tax,.. Redwood City Property Tax Bill.

From www.hauseit.com

NYC Property Tax Bills How to Download and Read Your Bill Redwood City Property Tax Bill What should i do if i do not have a secured property tax bill? redwood city, ca 94063. The treasurer/tax collector prepares and. Handles records of property descriptions,. the city of redwood city imposes taxes, assessments and fees, including a business license tax, transient occupancy tax,. if you did not receive a bill, or if you recently. Redwood City Property Tax Bill.

From dxotuvuvt.blob.core.windows.net

How To Find Your Property Tax Bill at Scott Slane blog Redwood City Property Tax Bill Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. if you did not receive a bill, or if you recently purchased a property, you may obtain a duplicate tax bill by calling (866) 220. the city of redwood city imposes taxes, assessments and fees, including a business license tax,. Redwood City Property Tax Bill.

From beta.hamilton.ca

Understanding Your Property Tax Bill City of Hamilton Redwood City Property Tax Bill the city of redwood city imposes taxes, assessments and fees, including a business license tax, transient occupancy tax,. What should i do if i do not have a secured property tax bill? redwood city, ca 94063. Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. Handles records of property. Redwood City Property Tax Bill.

From www.expressnews.com

Bexar property bills are complicated. Here’s what you need to know. Redwood City Property Tax Bill if you did not receive a bill, or if you recently purchased a property, you may obtain a duplicate tax bill by calling (866) 220. What should i do if i do not have a secured property tax bill? Handles records of property descriptions,. redwood city, ca 94063. Property taxes in redwood city usually range between $5,100 and. Redwood City Property Tax Bill.

From hxewpbmoq.blob.core.windows.net

Redwood City Ca Property Tax Rate at Renee Powell blog Redwood City Property Tax Bill redwood city, ca 94063. What should i do if i do not have a secured property tax bill? The treasurer/tax collector prepares and. if you did not receive a bill, or if you recently purchased a property, you may obtain a duplicate tax bill by calling (866) 220. the city of redwood city imposes taxes, assessments and. Redwood City Property Tax Bill.

From www.dailybreeze.com

How to read your property tax bill Daily Breeze Redwood City Property Tax Bill The treasurer/tax collector prepares and. Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. What should i do if i do not have a secured property tax bill? Handles records of property descriptions,. if you did not receive a bill, or if you recently purchased a property, you may obtain. Redwood City Property Tax Bill.

From www.sheboyganwi.gov

Important Payment Info on Property Tax Bills Redwood City Property Tax Bill What should i do if i do not have a secured property tax bill? The treasurer/tax collector prepares and. Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. Handles records of property descriptions,. if you did not receive a bill, or if you recently purchased a property, you may obtain. Redwood City Property Tax Bill.

From www.pinterest.com

NYC Property Tax Bills How to Download and Read Your Bill Redwood City Property Tax Bill redwood city, ca 94063. The treasurer/tax collector prepares and. Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. What should i do if i do not have a secured property tax bill? if you did not receive a bill, or if you recently purchased a property, you may obtain. Redwood City Property Tax Bill.

From beta.hamilton.ca

Understanding Your Property Tax Bill City of Hamilton Redwood City Property Tax Bill if you did not receive a bill, or if you recently purchased a property, you may obtain a duplicate tax bill by calling (866) 220. redwood city, ca 94063. Handles records of property descriptions,. the city of redwood city imposes taxes, assessments and fees, including a business license tax, transient occupancy tax,. Property taxes in redwood city. Redwood City Property Tax Bill.

From www.farmhillneighborhood.com

Redwood City News Residents Oppose Proposal Adding Sewer Fees to Redwood City Property Tax Bill What should i do if i do not have a secured property tax bill? redwood city, ca 94063. the city of redwood city imposes taxes, assessments and fees, including a business license tax, transient occupancy tax,. Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. if you did. Redwood City Property Tax Bill.

From blanker.org

Texas Property Tax Bill Forms Docs 2023 Redwood City Property Tax Bill Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. if you did not receive a bill, or if you recently purchased a property, you may obtain a duplicate tax bill by calling (866) 220. What should i do if i do not have a secured property tax bill? The treasurer/tax. Redwood City Property Tax Bill.

From www.pinterest.com

How To Read Your Property Tax Bill O'Connor Property Tax Reduction Redwood City Property Tax Bill the city of redwood city imposes taxes, assessments and fees, including a business license tax, transient occupancy tax,. Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. redwood city, ca 94063. Handles records of property descriptions,. The treasurer/tax collector prepares and. if you did not receive a bill,. Redwood City Property Tax Bill.

From peninsula360press.com

Redwood City to seek to charge sewer service on property tax bill Redwood City Property Tax Bill Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. The treasurer/tax collector prepares and. the city of redwood city imposes taxes, assessments and fees, including a business license tax, transient occupancy tax,. if you did not receive a bill, or if you recently purchased a property, you may obtain. Redwood City Property Tax Bill.

From www.hauseit.com

NYC Property Tax Bills How to Download and Read Your Bill Redwood City Property Tax Bill Handles records of property descriptions,. the city of redwood city imposes taxes, assessments and fees, including a business license tax, transient occupancy tax,. if you did not receive a bill, or if you recently purchased a property, you may obtain a duplicate tax bill by calling (866) 220. What should i do if i do not have a. Redwood City Property Tax Bill.

From www.alpharetta.ga.us

Property Tax Bills Mailed To Residents Redwood City Property Tax Bill if you did not receive a bill, or if you recently purchased a property, you may obtain a duplicate tax bill by calling (866) 220. Handles records of property descriptions,. Property taxes in redwood city usually range between $5,100 and $19,550, with the average tax bill sitting at. What should i do if i do not have a secured. Redwood City Property Tax Bill.